What's included in the Operating Referendum?

The proposed operating referendum would provide approximately $500,000 per year in additional funding to help the School District continue offering essential services. This includes maintaining transportation routes, supporting classroom instruction, and retaining qualified staff. The funding would help the District manage rising costs without reducing services.

Instructions

Click to View Steps

- Access the Fillmore County GIS property search

- Search for your property using your address or parcel ID

- Once on your Parcel Report, scroll to locate the “Valuation Notice” heading

- Click the file named “2025 Valuation Notice (PDF)”

- The Valuation Notice will open in a separate tab

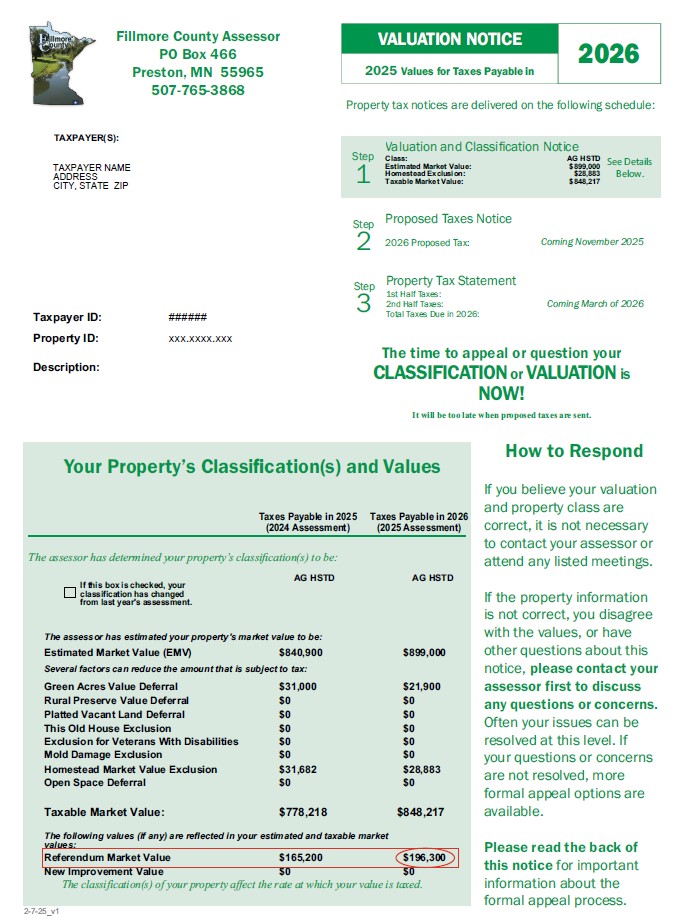

- Locate the amount listed as “Referendum Market Value” for Taxes Payable in 2026 (as shown circled below)

- Input this number on this page below, click “Calculate” and the estimated impact will appear

Estimated Tax Impact

Frequently Asked Questions

Where do I find my Referendum Market Value (RMV)?

Visit the Fillmore County GIS to search for your property by address or parcel ID.

To locate your RMV, utilize the Instructions given towards the top of this webpage.

Where do I vote?

Depending on your precinct, you will vote at one of the combined polling places listed below:

For those located in the City of Preston, City of Fountain, and Townships of Chatfield, Carrolton, Fountain, Preston, Forestville, and Carimona, you will vote at Fillmore Central ISD #2198 District Office located at 700 Chatfield St., Preston, MN 55965.

For those located in the City of Harmony, and Townships of Amherst, Bristol, Canton, Harmony, and York, you will vote at the Harmony Community Building located at 225 Third Ave. SW, Harmony, MN 55939.

Please note that this notice applies only to school district elections not held on the day of a statewide election. Municipal or state elections may be held at a different location. If you wish further information on school district polling place locations, please contact Darla Ebner at the Fillmore Central District Office at (507) 765-3845

How is my estimated tax impact calculated?

The calculator uses your property’s Referendum Market Value (RMV) – which is the portion of your property value subject to the operating referendum – along with the proposed levy amount to estimate your potential tax increase.

Your RMV depends on your property type:

- Residential and commercial properties are taxed on their full RMV.

- Agricultural Homestead properties are taxed only on the value of the house, garage, and one acre.

- Seasonal recreational properties (like cabins) are not taxed under the operating referendums.

The calculator applies the estimated tax rate to your RMV to show how much your annual taxes might increase if the referendum is approved.

Does this estimate include other changes to my taxes?

No, this calculator only shows the estimated impact of the proposed levy. Other factors (like changes in your property’s value) may also affect your final tax bill.

Is this what I’ll actually pay?

This is an estimate based on current information and assumptions. The actual amount you owe is calculated each year using your property’s estimated market value for that specific tax assessment year.

When would these tax impacts take effect?

If approved, the levy would affect property tax bills starting in Pay 2026.

Would I pay for the operating referendum on my agricultural property?

For owners of Agricultural – Homestead property, you will be taxed on the RMV of your house, garage, and one (1) acre of land (commonly referred to as HGA). The Ag2School property tax credit does not apply to this proposed impact.

For owners of Agricultural – Non-Homestead property, your property will not be subject to the proposed increase.